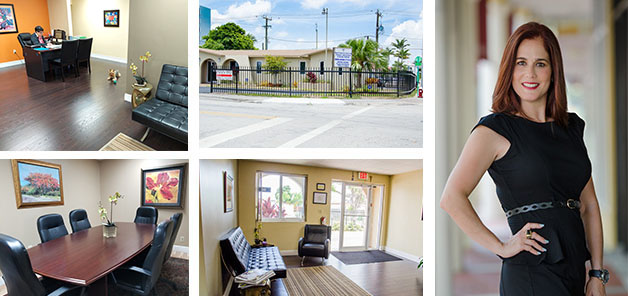

Commercial Auto Insurance Company Located in Hialeah, FL | LP Insurance Associates Inc.

Commercial Auto Insurance

If your business uses a vehicle, or many vehicles, whether owned leased or borrowed, If you operate an unusual vehicle, transport goods of others or special equipment, you need a commercial auto insurance policy.

Many business owners believe that if their car is in their personal name that a personal auto policy will cover the auto. There are exclusions that apply. If the vehicle is used primarily for commercial purposes, you need to purchase a commercial auto insurance policy.

Certain businesses must adhere to federal and state regulatory standards in the operation of their vehicles and may require specific coverage to comply with these regulations. The amount of coverage you need is based on many factors and a commercial auto policy can offer higher liability limits. After all, the larger vehicles can cause more damage than passenger cars.

LP Insurance can offer competitive quotes with multiple insurance companies to find the right coverage for your business.

These are a few of the factors that affect your premium:

- The Types of Vehicles you are operating: Trucks, trailers, semi's, vans, pickups, and even private passenger type vehicles.

- Who Operates your vehicles: the years experience and driving history of your drivers can provide discounts.

- Where your business is located: your address, particularly your zip code plays a part in how much you pay.

- Safety and anti theft devices: air bags, anti-lock brakes and alarms can all reduce your cost. Deductibles: the higher the deductible the lower your premium.

- At LP Insurance, we understand your commercial vehicles are important to your business, Let's talk - call us today so we can get you covered.

Call LP Insurance today, so we can meet to determine the best business Commercial Auto Insurance coverage that is best suited for your business - no matter the size.